Good news for culinary business owners! Now, ESB Core has a new feature, namely the VAT Invoice Number. This feature comes with benefits designed to assist users in controlling and utilizing registered sales tax invoice numbers issued by the Directorate General of Taxes (DJP). Additionally, every sales invoice document or simple sales using a tax invoice number from the DJP will automatically display information for reporting. This not only facilitates your restaurant business in fulfilling tax obligations but also helps reduce the potential for human errors and ensures compliance with applicable tax regulations.

Value-Added Tax (VAT) is a type of tax imposed on the value added to a product or service at each stage of production or distribution. For restaurant businesses, VAT plays an important role in collecting revenue for the government from the sale of food and beverages to consumers. The functions of VAT for restaurant businesses include calculating and levying taxes on the services provided, as well as presenting accurate financial reports in accordance with applicable tax regulations.

How to Use the VAT Invoice Number Feature

Here's how to set up the use of the new feature in ESB Core, namely the VAT Invoice Number.

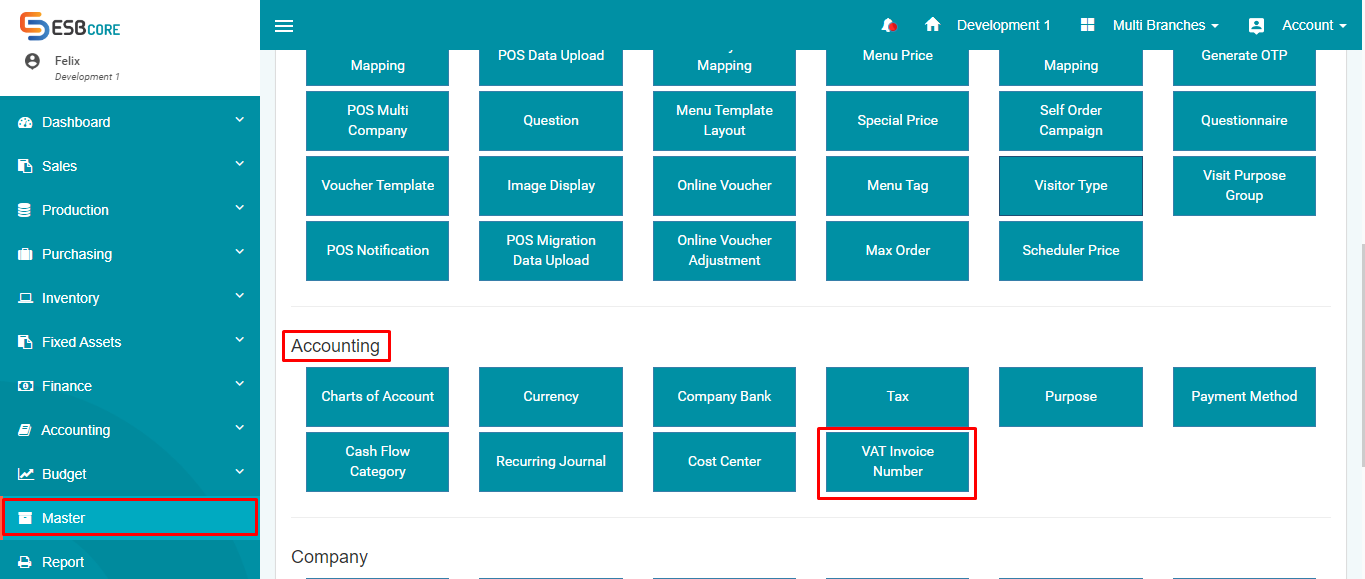

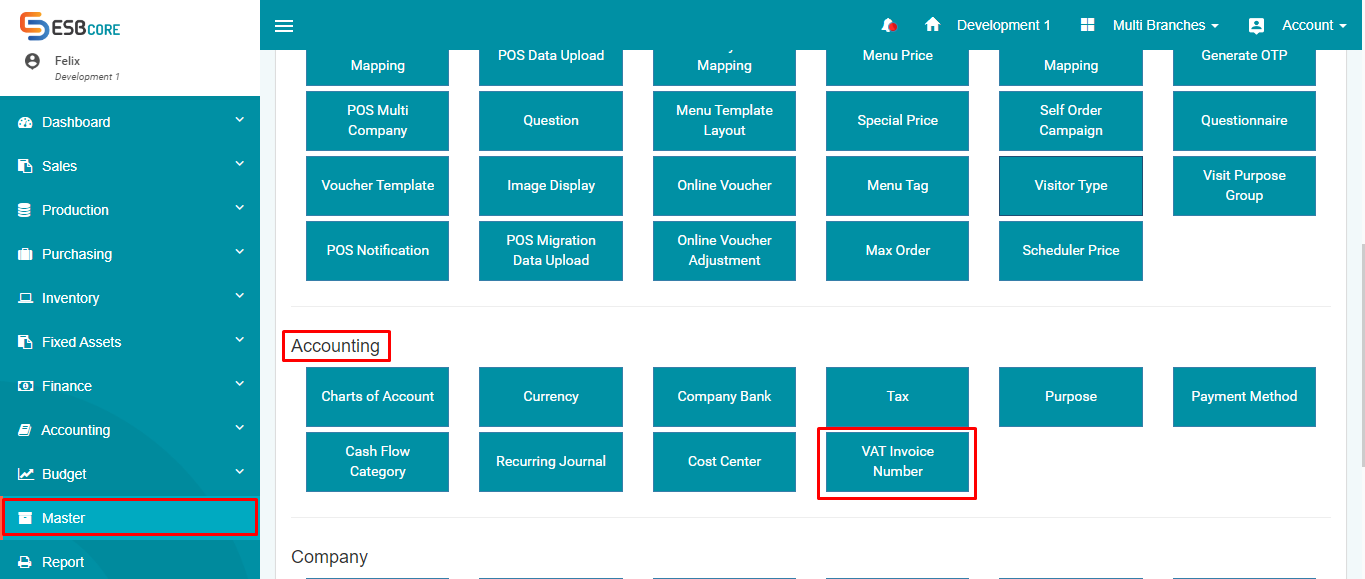

- Users can register the tax invoice numbers provided by the Directorate General of Taxes (DJP) in the VAT Invoice Number Master. The master can be accessed through the menu: Master > Accounting > VAT Invoice Number.

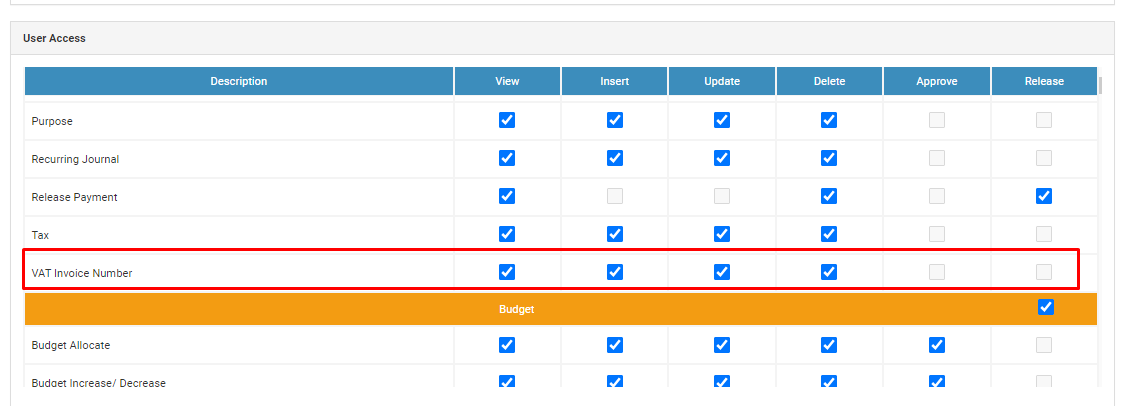

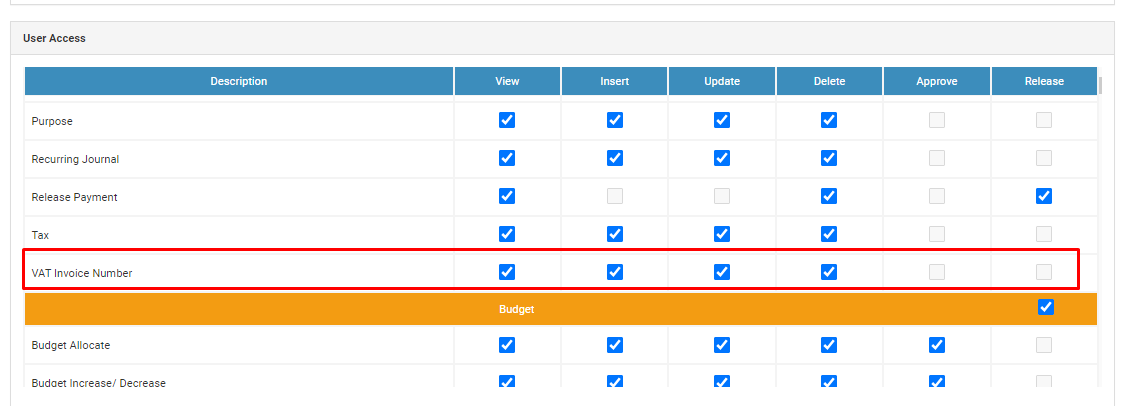

Make sure that authorized users to manage the VAT Invoice Number data have been granted access rights in the User Role: Master > User Role > Accounting > VAT Invoice Number.

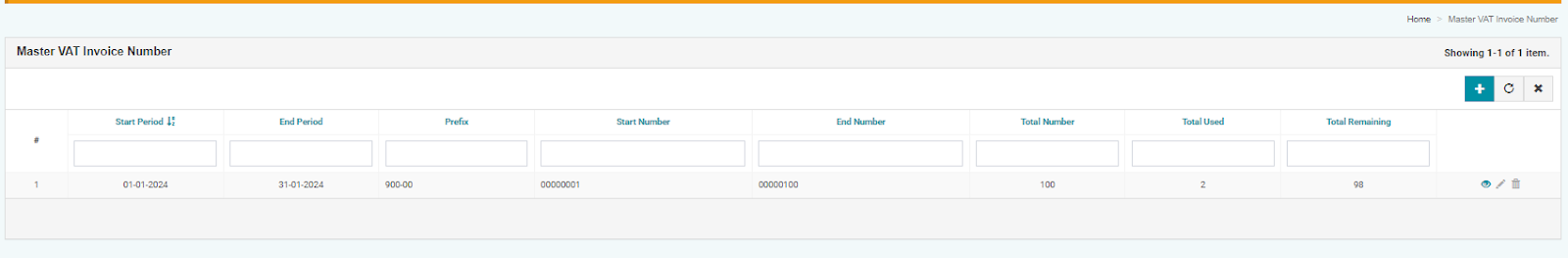

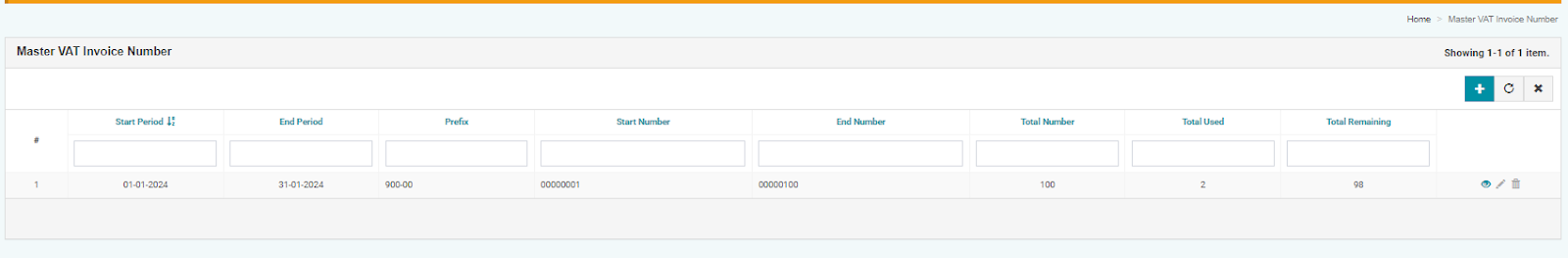

Below is the display of the master index of VAT Invoice Numbers.

With Index Explanation

|

#

|

Column

|

Description

|

|

1

|

Start Period

|

The determination for the starting date of the VAT invoice number data can be based on sales invoice transactions or simple sales.

|

|

2

|

End period

|

The determination for the end date of the VAT invoice number data can be based on either sales invoice transactions or simple sales.

|

|

3

|

Prefix

|

Combination of tax invoice number prefixes.

|

|

4

|

Start Number

|

The combination of the first 8 digits of the tax invoice number that can be used.

|

|

5

|

End Number

|

The combination of the last 8 digits of the tax invoice number that can be used.

|

|

6

|

Total Number

|

Total number of tax invoices that can be used for sales invoice transactions or simple sales.

|

|

7

|

Total Used

|

The total number of tax invoices that have been used.

|

|

8

|

Total Remaining

|

The total remaining tax invoice numbers that can be used.

|

|

9

|

Add Button ( ) )

|

- Used to add VAT Invoice Number master data.

- When you click the add button, it will directly go to the create VAT Invoice Number menu.

|

|

10

|

View Button ( ) )

|

- Used to view detailed data of the VAT Invoice Number master

- When clicking the view button, it will direct you to the VAT Invoice Number view menu.

|

|

11

|

Edit Button ( ) )

|

- Used to change the master data of the VAT Invoice Number.

- When clicking the edit button, it will directly access the edit VAT Invoice Number menu.

- The edit button will be disabled when the tax invoice number is already used in sales invoice or simple sales transactions.

|

|

12

|

Delete Button ( ) )

|

- Used to delete VAT Invoice Number master data.

- When the delete button is clicked, the VAT Invoice Number master data will be deleted (hard delete).

- The delete button will be disabled when the tax invoice number is already used in sales invoice or simple sales transactions.

|

|

13

|

Refresh Data Button ( ) )

|

Used to update displayed data

|

|

14

|

Clear Filter Button ( ) )

|

Used to reset the filter to its default settings.

|

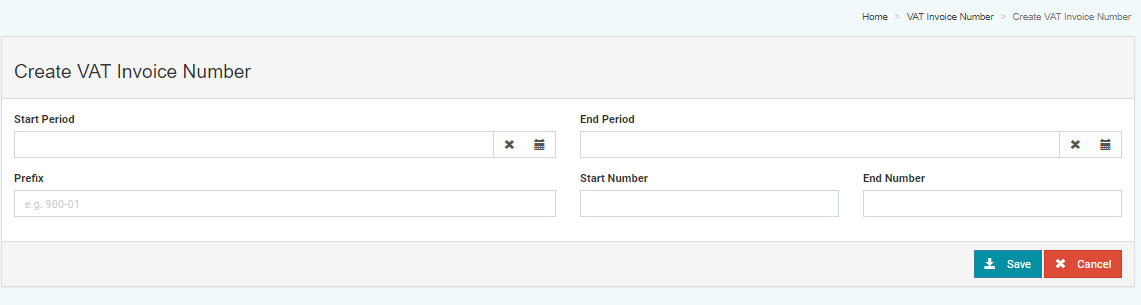

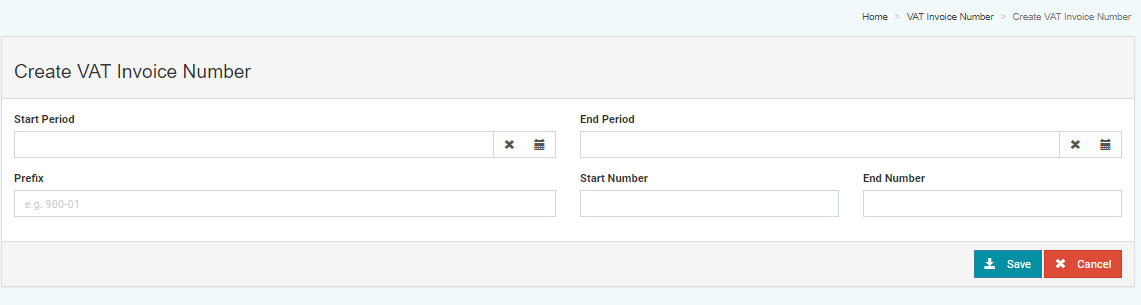

Below is the Create VAT Invoice Number page.

With image description

|

#

|

Column

|

Description

|

|

1

|

Start Period

|

- The Start Period column must be filled in.

- Start Period cannot be greater than the end period.

- The format of Start Period is dd-mm-yyyy.

|

|

2

|

End Period

|

- The End Period column must be filled in.

- End Period cannot be earlier than Start Period.

- The format of the Start Period is dd-mm-yyyy.

|

|

3

|

Prefix

|

- The Prefix column must be filled

- The number of characters must be 5 digits

- It can only be filled with numbers

|

|

4

|

Start Number

|

- The Start Number column must be filled in.

- The character count must be 8 digits.

- Only numeric characters are allowed.

- The Start Number value must not be greater than the End Number.

|

|

5

|

End Number

|

- The "End Number" column must be filled in.

- The number of characters must be 8 digits.

- Only numbers can be entered.

- The End Number value must not be smaller than the Start Number.

|

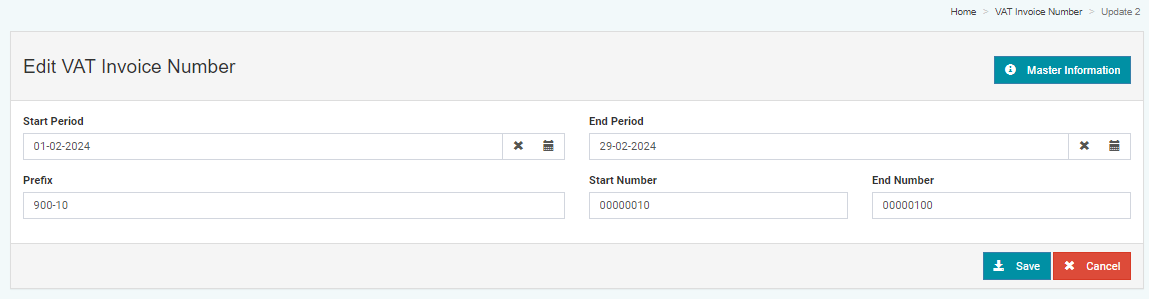

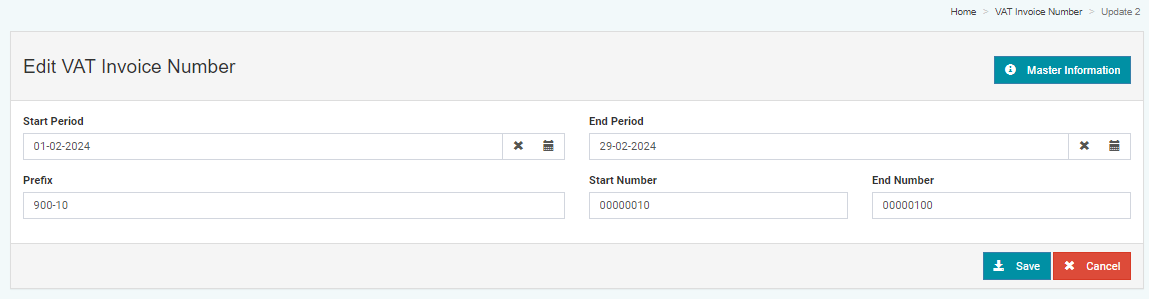

Below is the menu to edit the VAT Invoice Number.

With Picture Description

|

#

|

Column

|

Description

|

|

1

|

Start Period

|

- The Start Period column must be filled in.

- Start Period cannot be greater than the end period.

- The format of Start Period is dd-mm-yyyy.

|

|

2

|

End Period

|

- The End Period column must be filled in.

- The End Period cannot be earlier than the Start Period.

- The Start Period format is dd-mm-yyyy.

|

|

3

|

Prefix

|

- Column Prefix must be filled

- The number of characters must be 5 digits

- Can only be filled with numbers

|

|

4

|

Start Number

|

- The Start Number column must be filled.

- The number of characters must be 8 digits.

- Only numerical values can be entered.

- The Start Number value must not be greater than the End Number.

|

|

5

|

End Number

|

- The "End Number" column must be filled in.

- The number of characters must be 8 digits.

- Only numbers can be entered.

- The "End Number" value must not be smaller than the "Start Number".

|

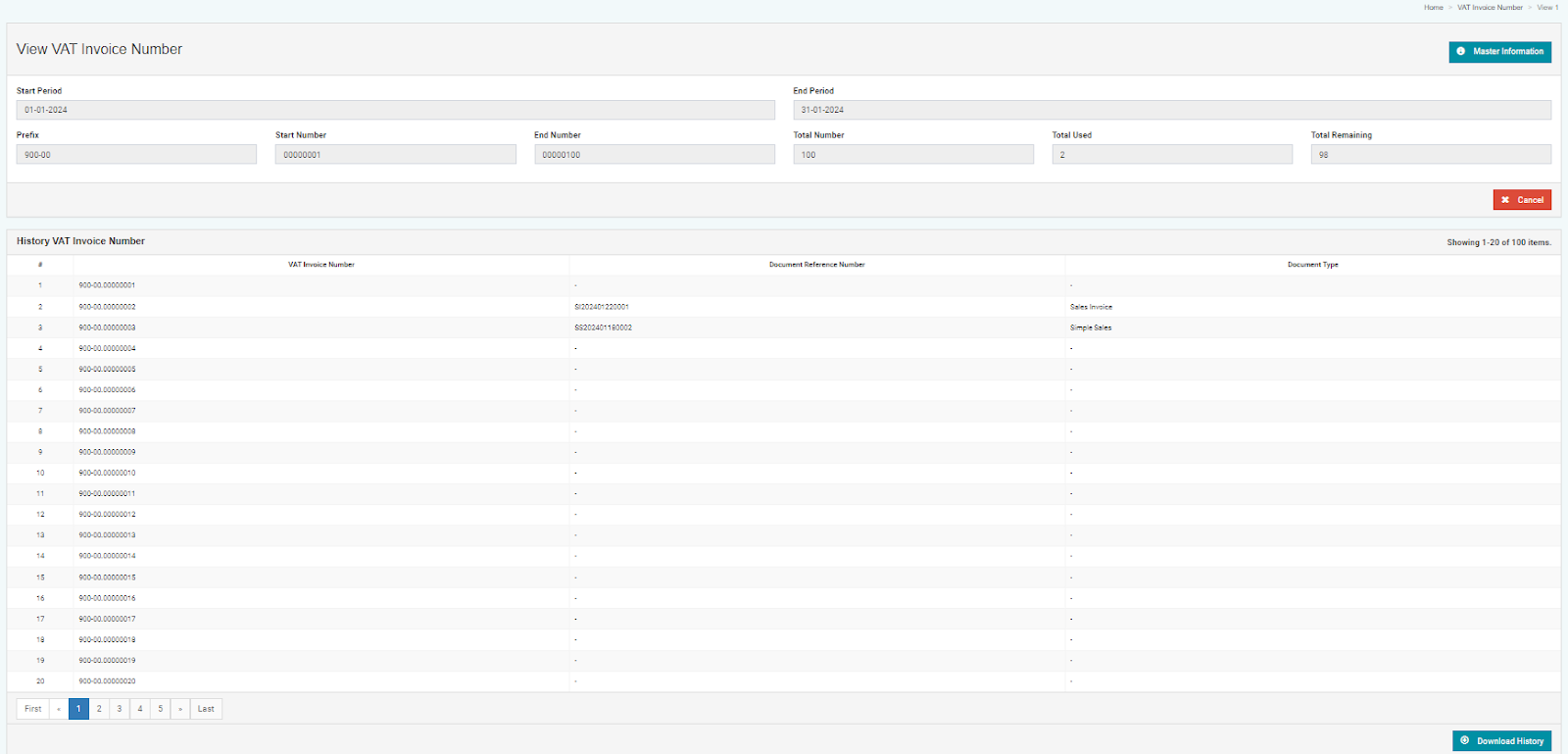

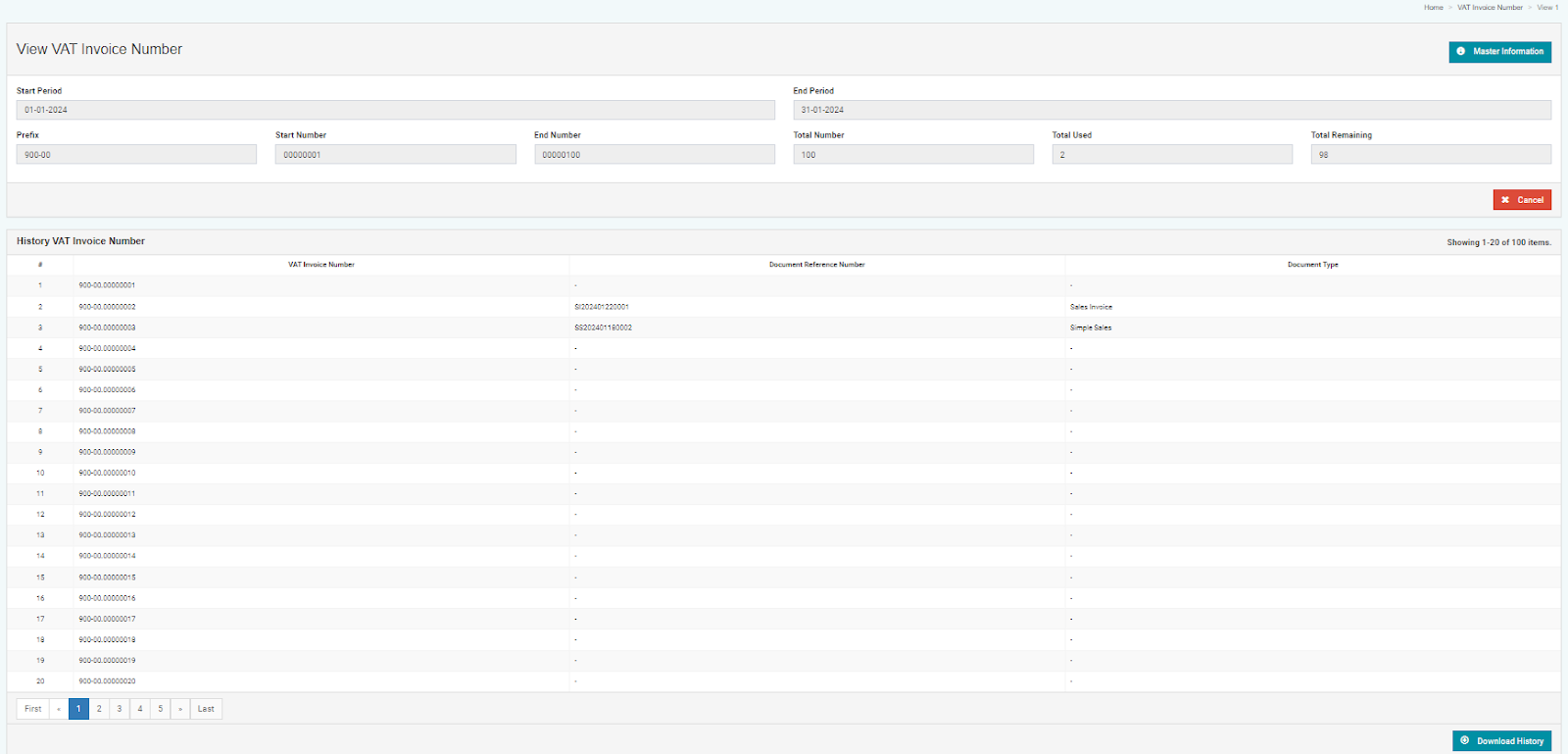

Below is the "View VAT Invoice Number" menu.

With Picture Description

|

#

|

Column

|

Description

|

|

1

|

Start Period

|

The information on the start date of using the VAT invoice number data can be based on sales invoice transactions or simple sales.

|

|

2

|

End period

|

The expiration date information for the VAT invoice number data can be used based on sales invoice transactions or simple sales.

|

|

3

|

Prefix

|

Combination of tax invoice number prefixes.

|

|

4

|

Start Number

|

Initial information on tax invoice numbers that can be used.

|

|

5

|

End Number

|

The final information on the tax invoice number that can be used

|

|

6

|

Total Number

|

The total number of tax invoice numbers that can be used for sales invoice transactions or simple sales. Obtained from the sum of Start Number to End Number.

|

|

7

|

Total Used

|

Total number of tax invoices that have been used

|

|

8

|

Total Remaining

|

The total remaining tax invoice numbers that can be used

|

|

9

|

Section History VAT Invoice Number

|

- Used to inform that the tax invoice number has been registered.

- If the number has been used, there will be information that the tax invoice number has been used in sales invoice transactions or simple sales along with the transaction number.

|

|

10

|

VAT Invoice Number

|

Available tax invoice numbers

|

|

11

|

Document Reference Number

|

The transaction number that uses the tax invoice number.

|

|

12

|

Document Type

|

The type of transaction where the tax invoice number is used.

|

|

13

|

Tombol Download History

|

Used to download tax invoice number history data into an Excel file.

|

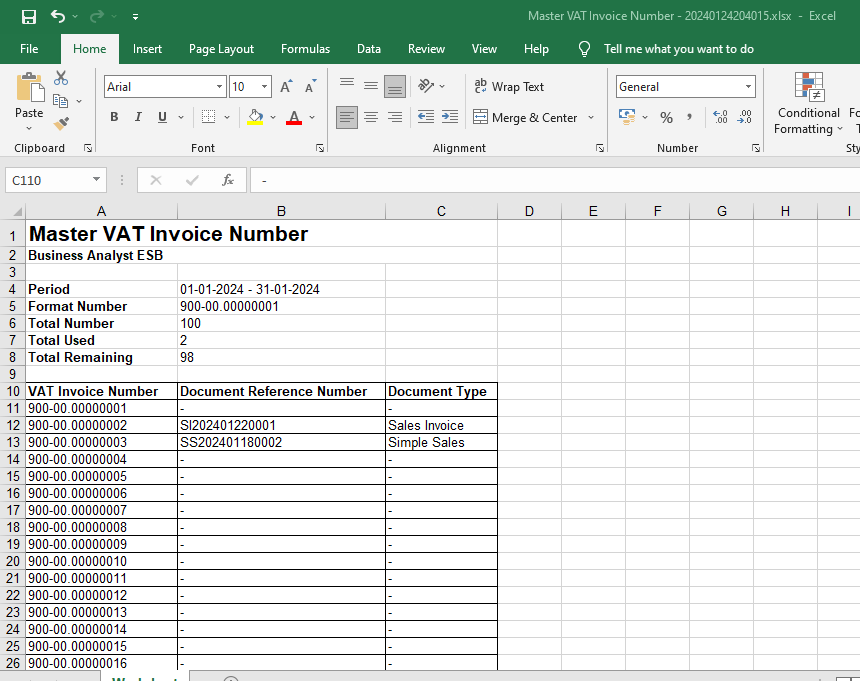

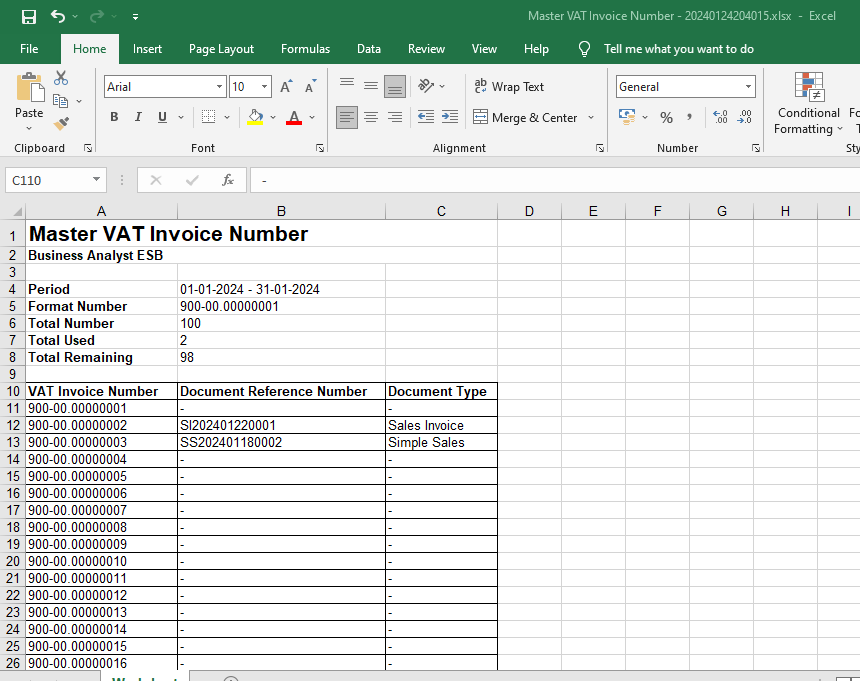

Here are the results of downloading the VAT invoice number.

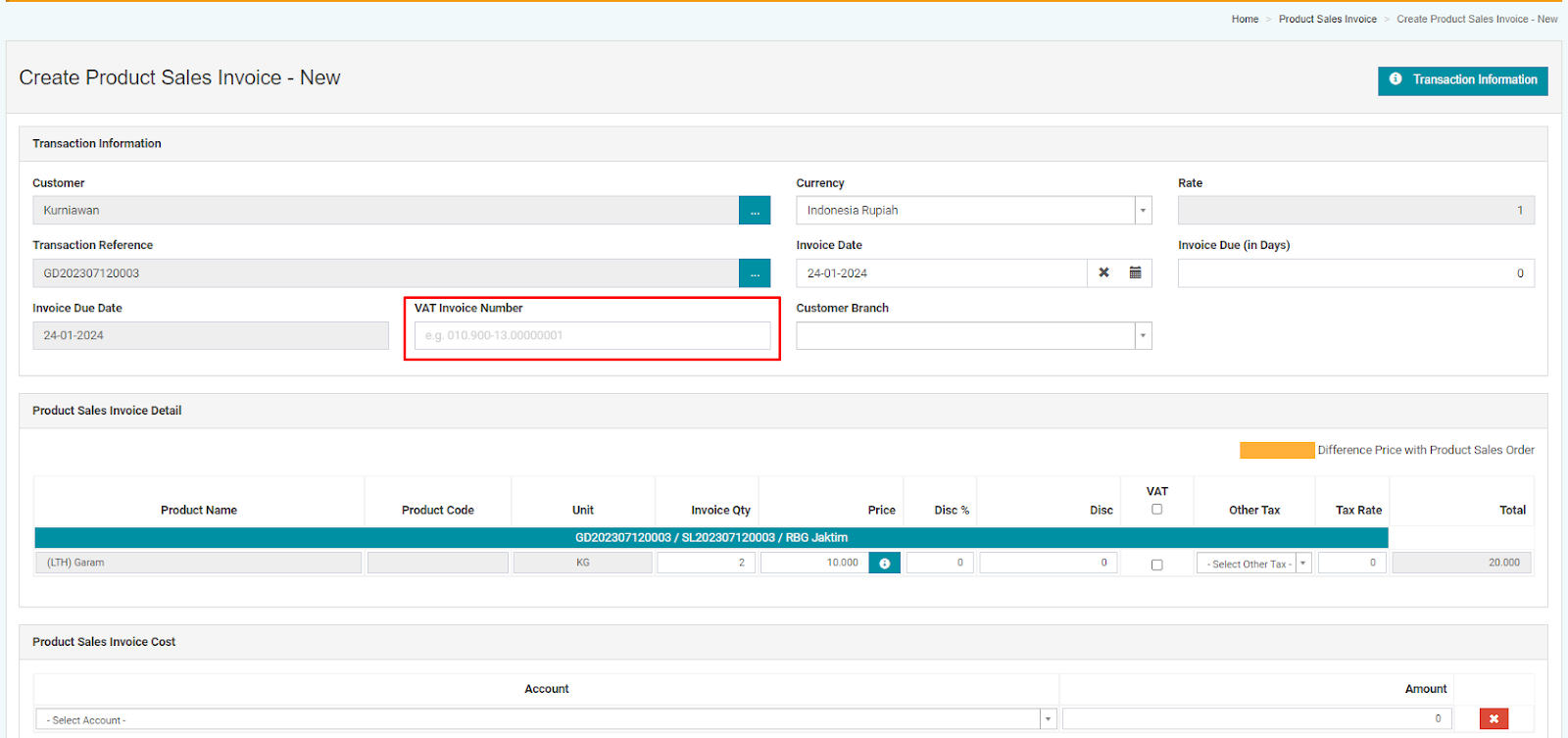

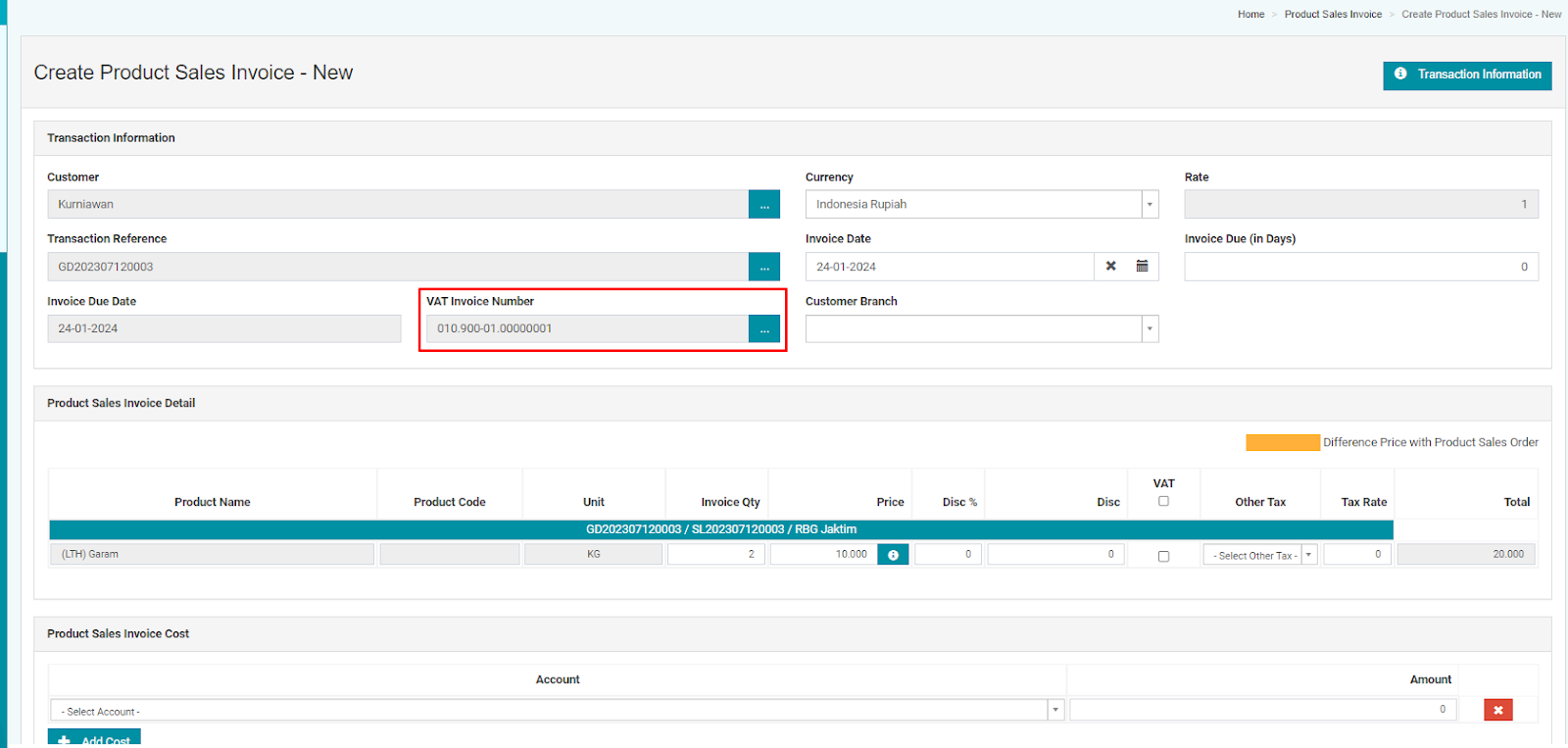

1. Sales Invoice Transactions

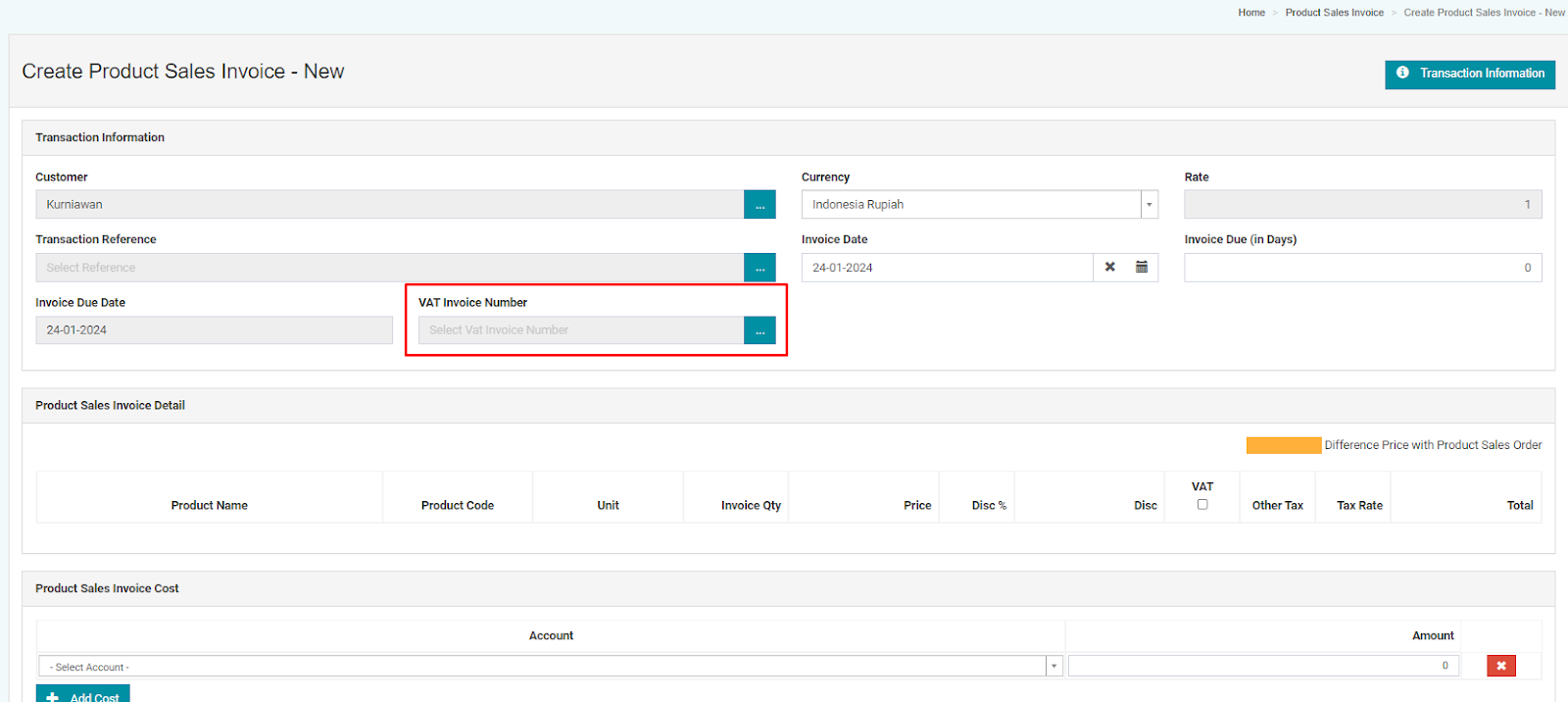

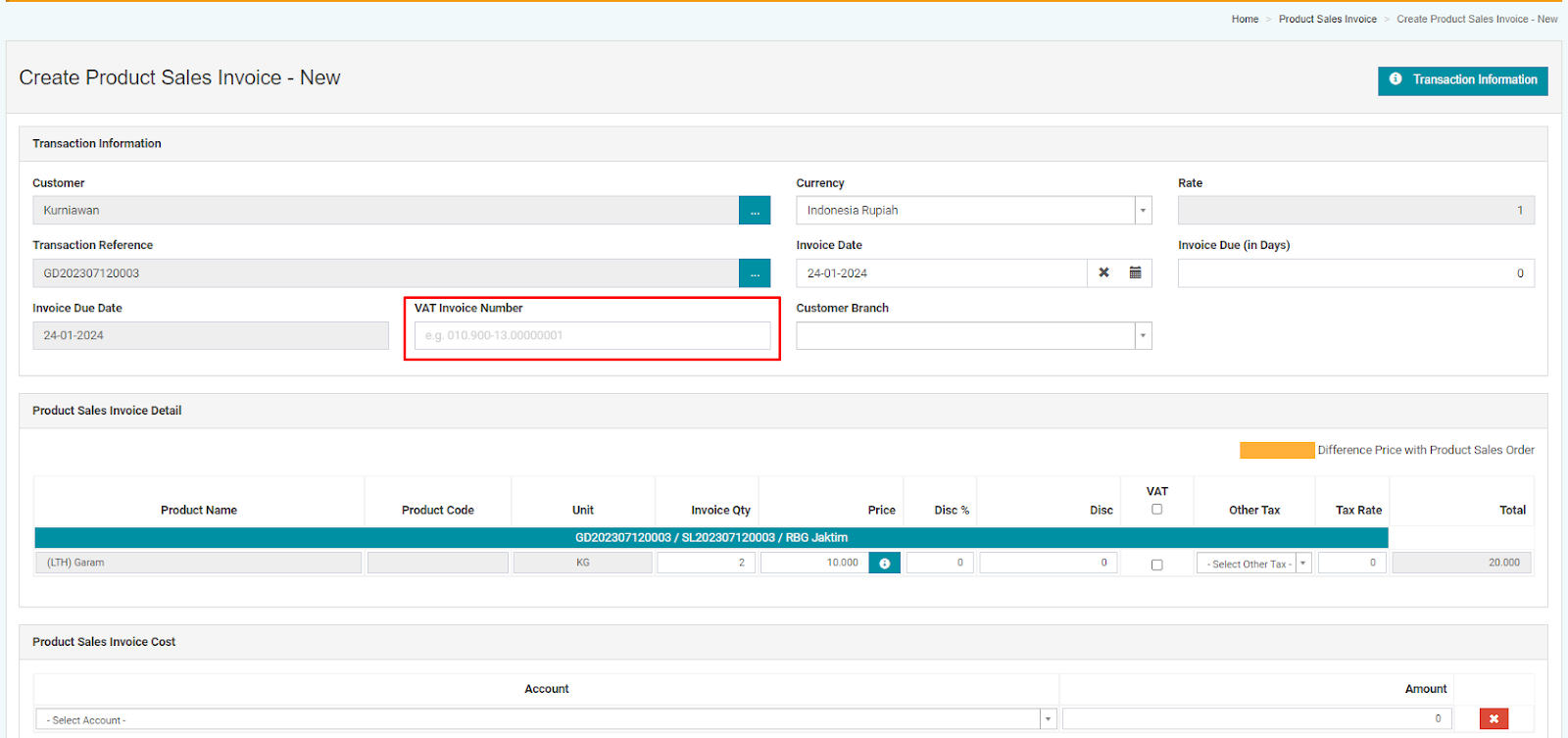

- If the Master VAT Invoice Number data is not available, users can manually fill in the VAT Invoice Number column. As shown in the example below.

- If the Master VAT Invoice Number already contains data, then in the VAT Invoice Number column, the user can select the VAT Invoice Number corresponding to the number registered in the master.

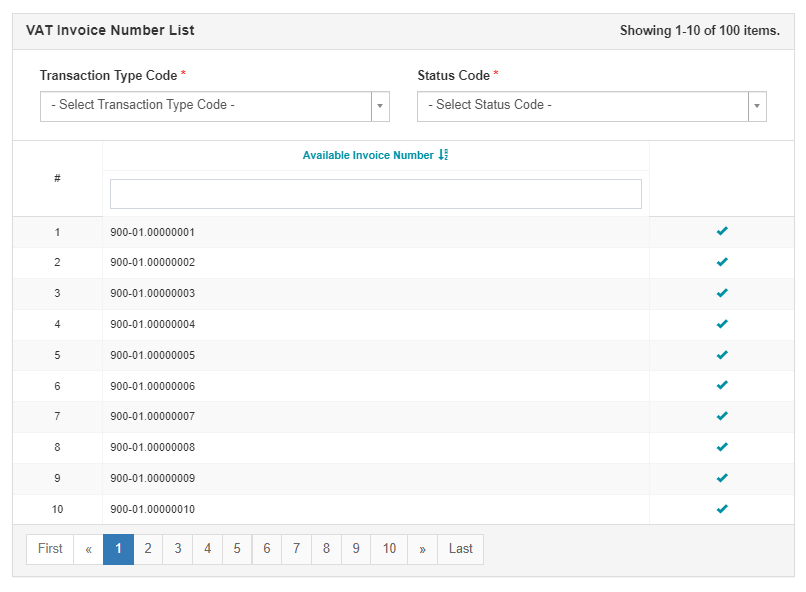

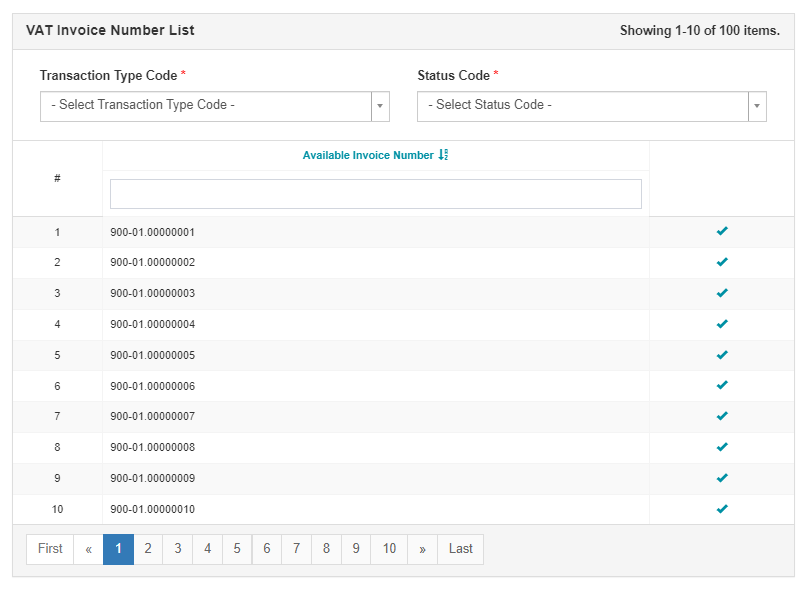

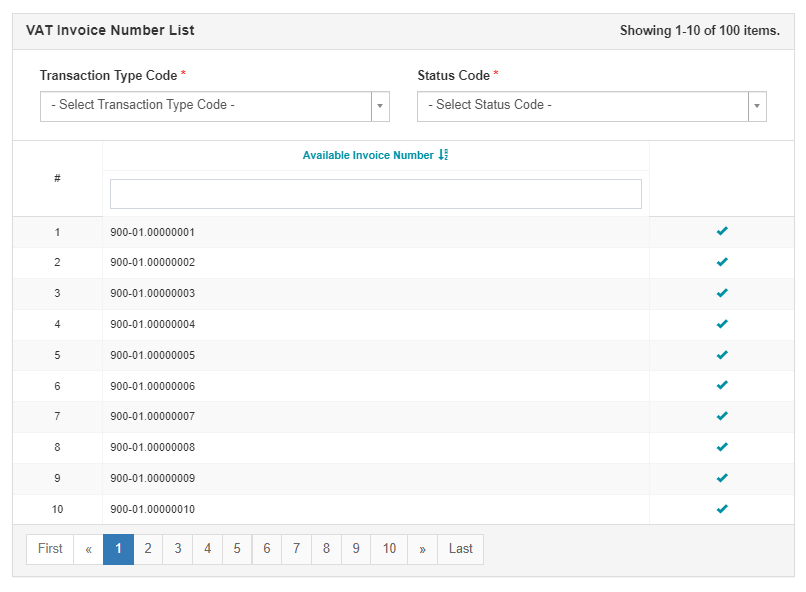

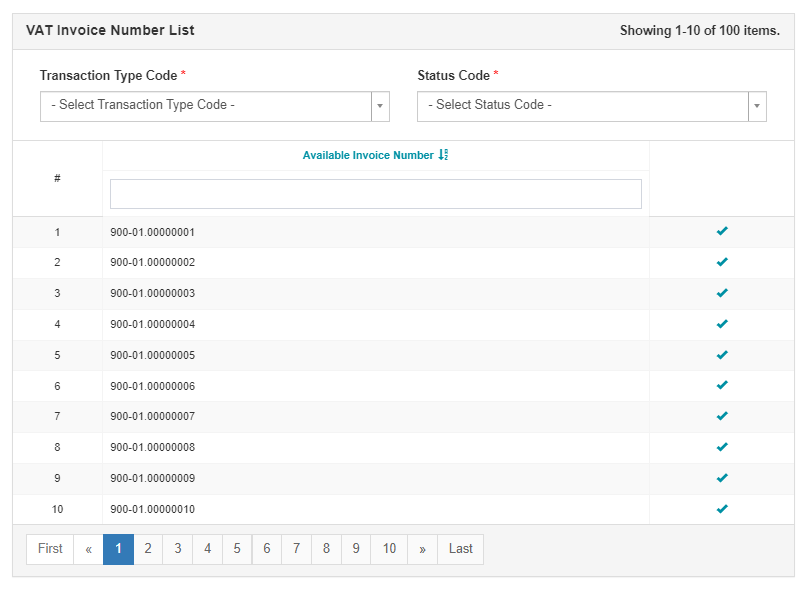

When you click on VAT Invoice Number browse, a popup will appear as shown in the image below.

Image Description

|

#

|

Column

|

Description

|

|

1

|

Transaction Type Code

|

- The column must be filled in.

- The selectable data list ranges from 01 to 09.

|

|

2

|

Status Code

|

- The column must be filled.

- The selectable data list consists of 0 and 1.

|

|

3

|

Available Invoice Number

|

- To select the tax invoice number to be used,

- Only the tax invoice numbers that have not been used are displayed.

- Once selected, the data displayed in the VAT invoice number column is the combination of Transaction Type Code + Transaction Code + the selected tax invoice number.

|

|

4

|

Reference on How to Read Tax Invoice Numbers

|

https://www.online-pajak.com/tentang-ppn-efaktur/nomor-seri-faktur-pajak

|

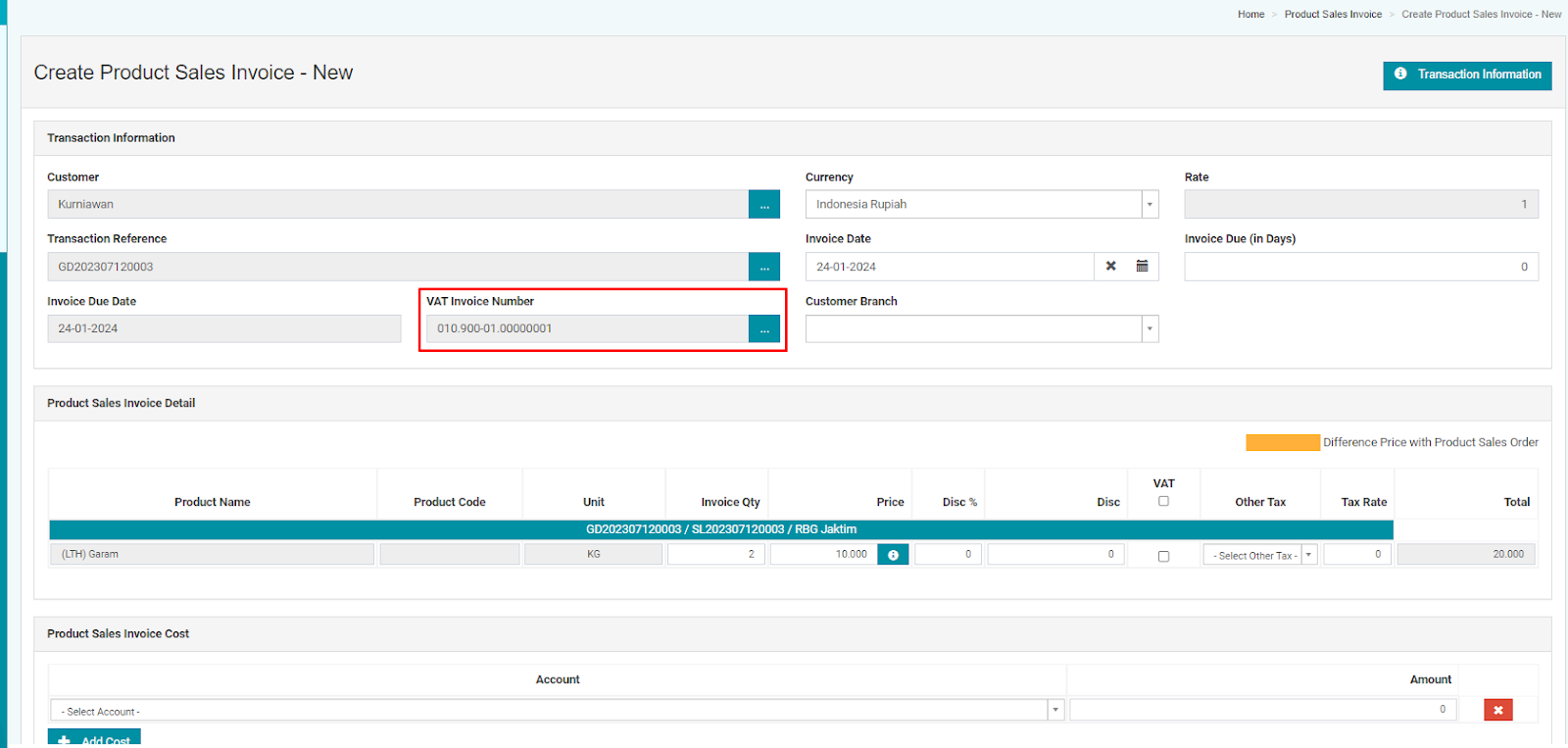

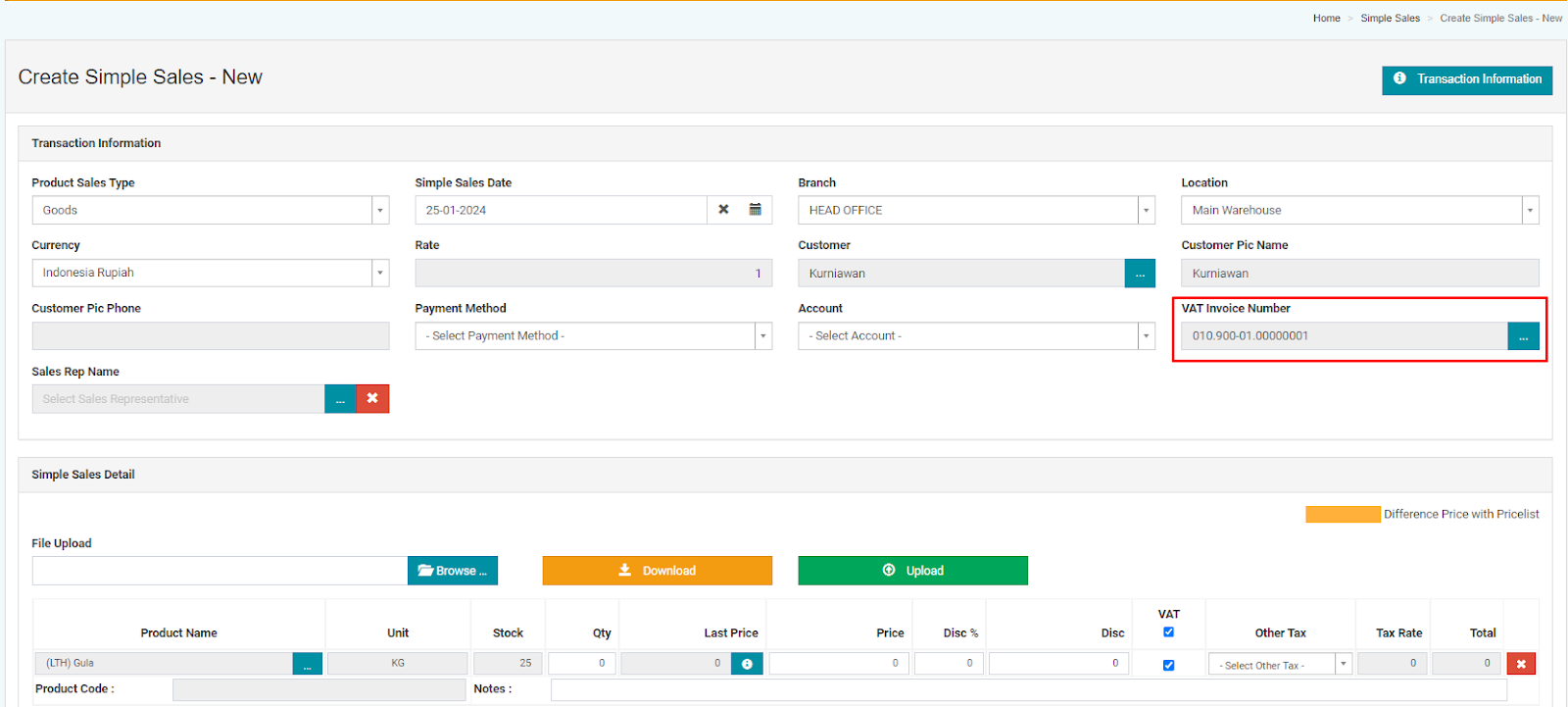

Example of VAT Invoice Number data after selection

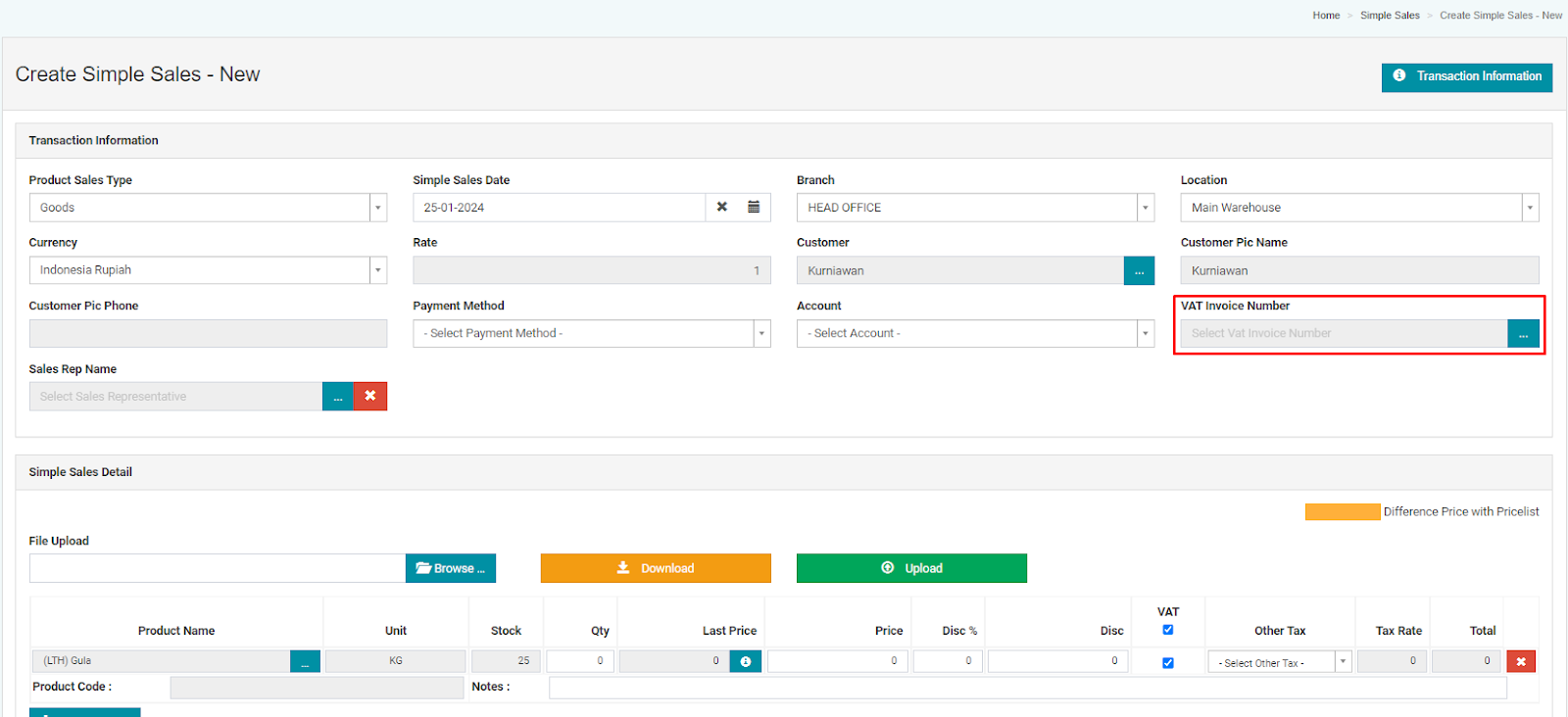

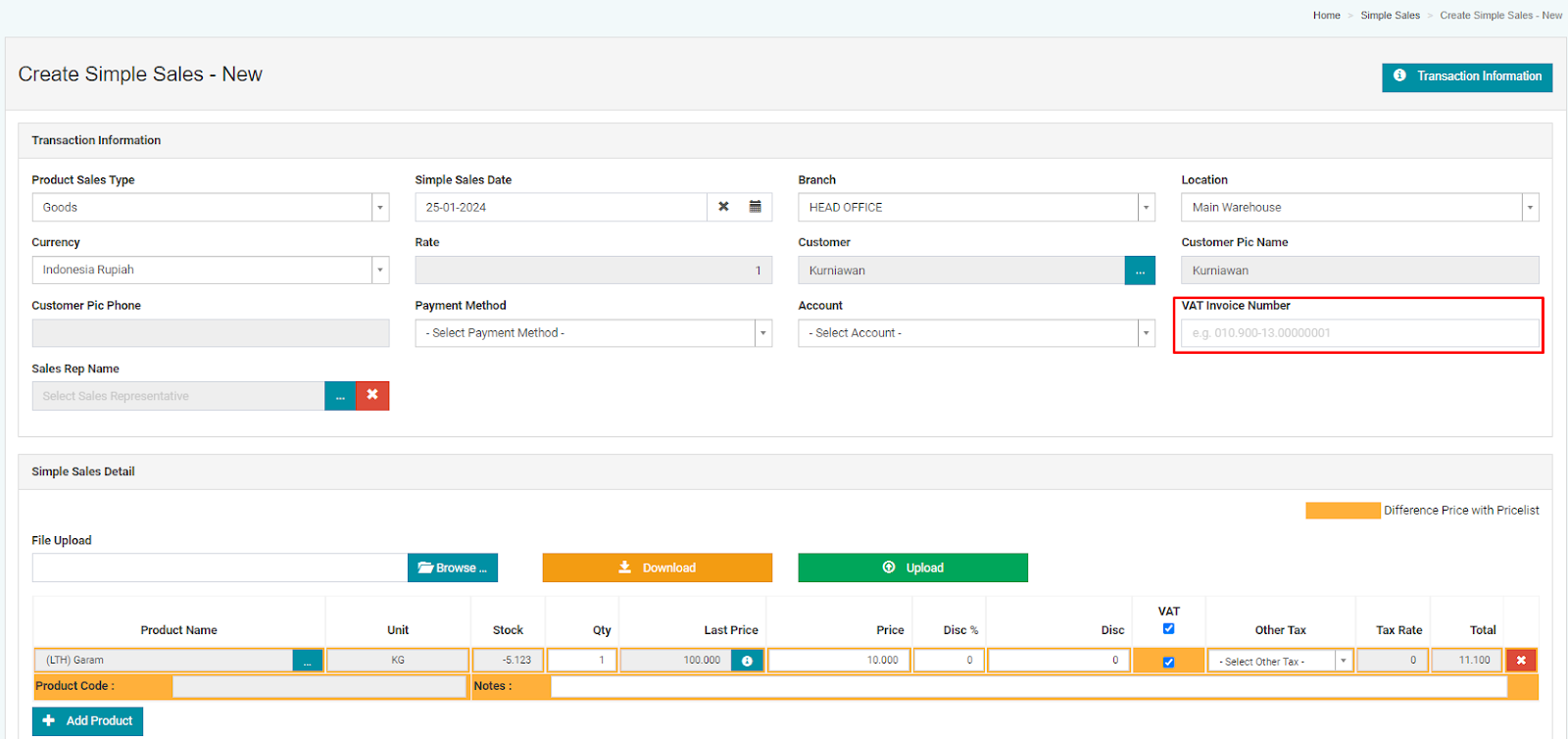

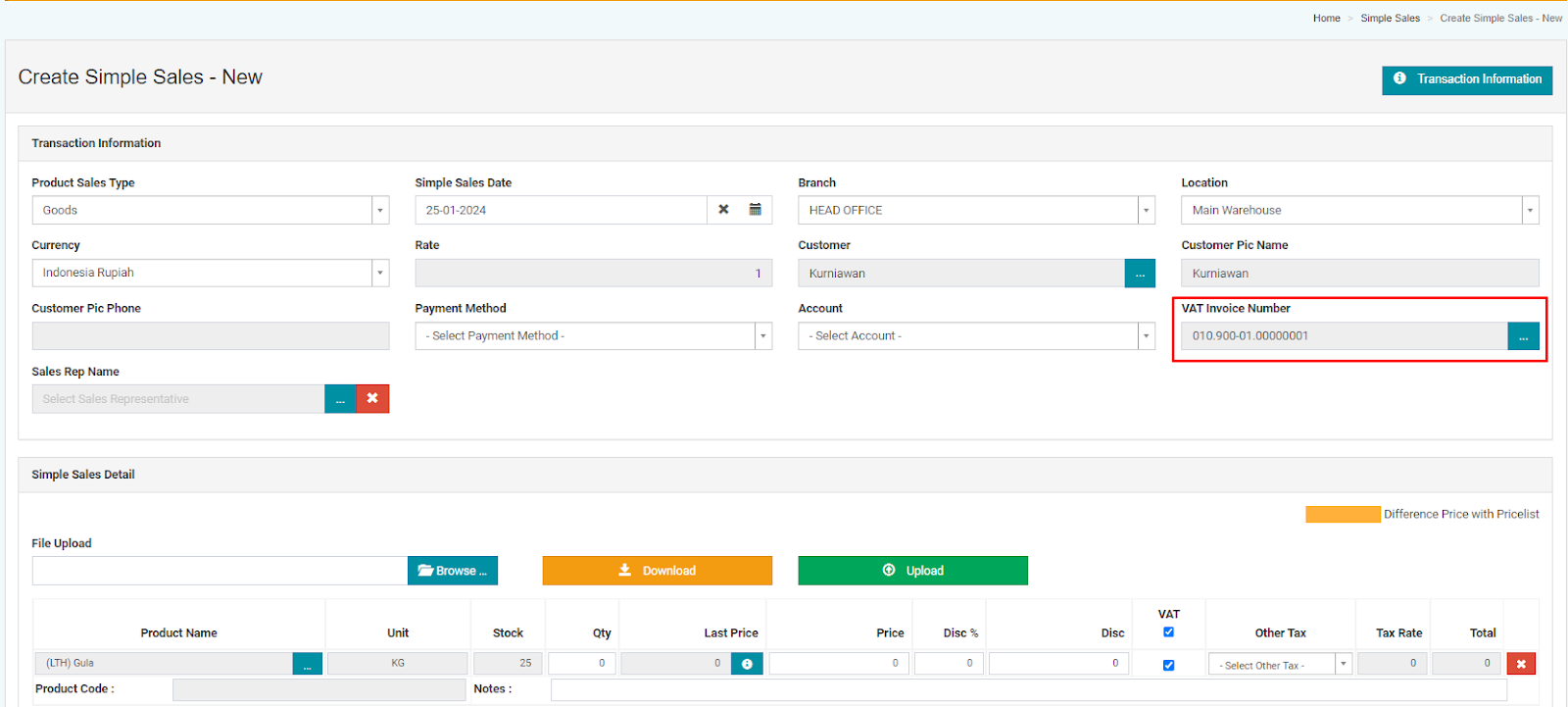

2. Simple Sales Transactions

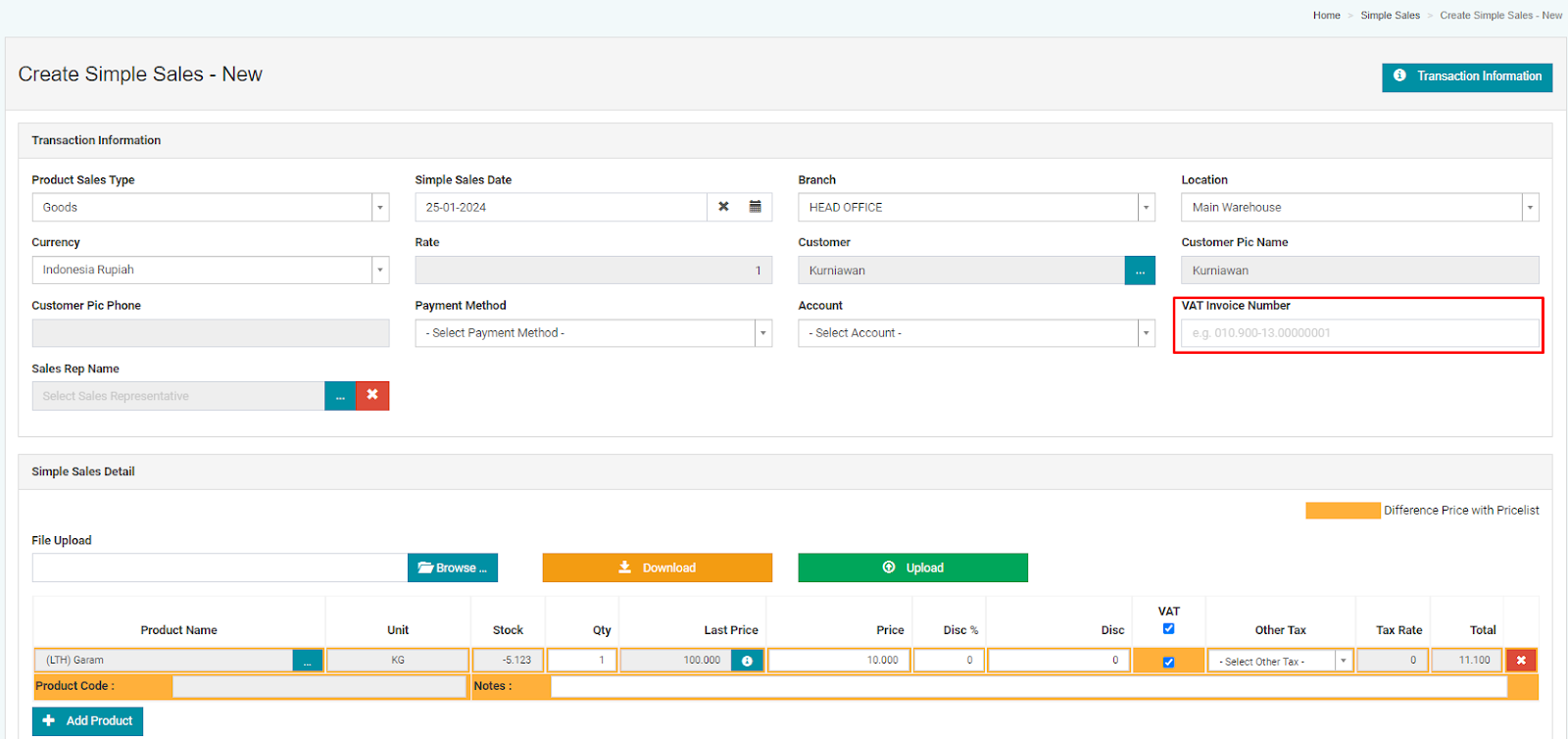

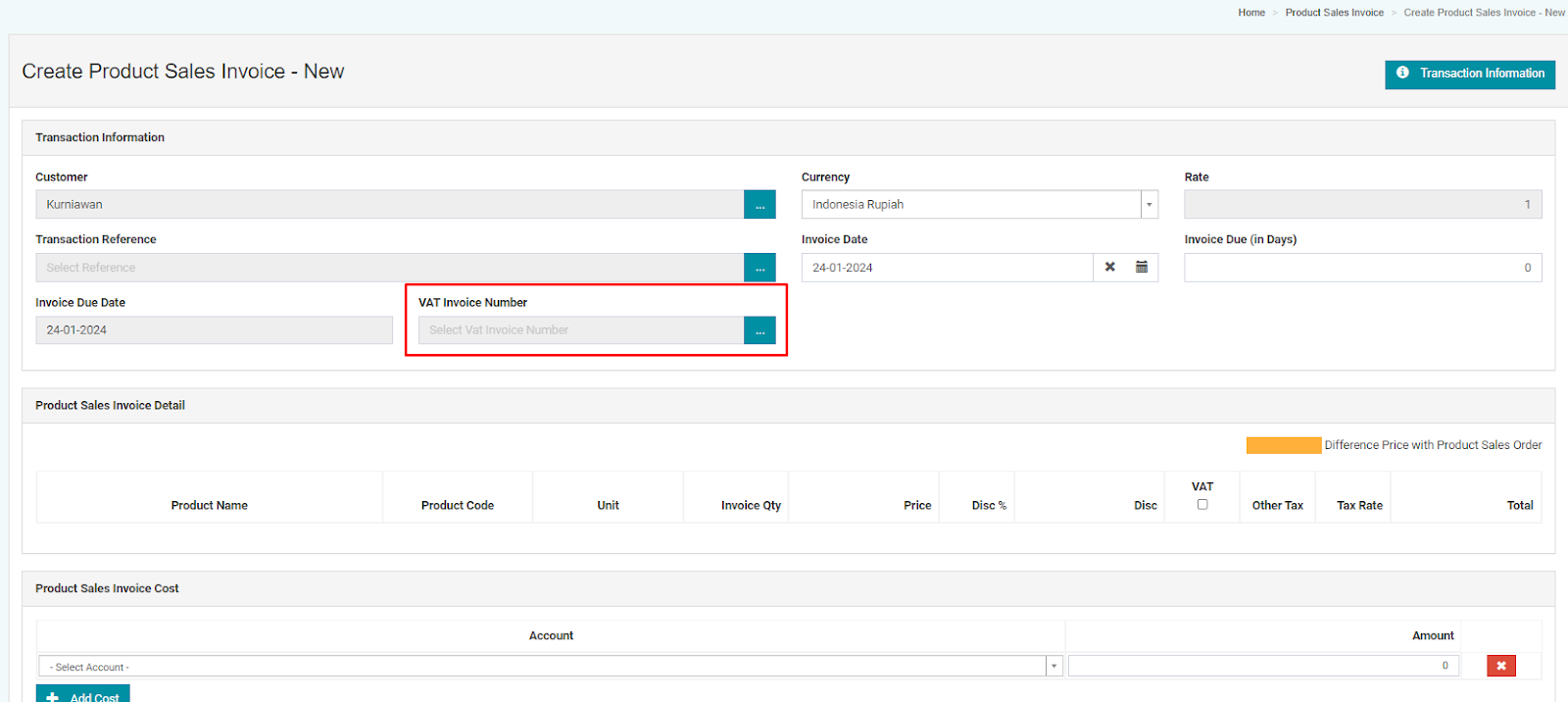

- If the Master VAT Invoice Number does not have any data yet, users can manually input the VAT Invoice Number in the designated column, as shown in the example below.

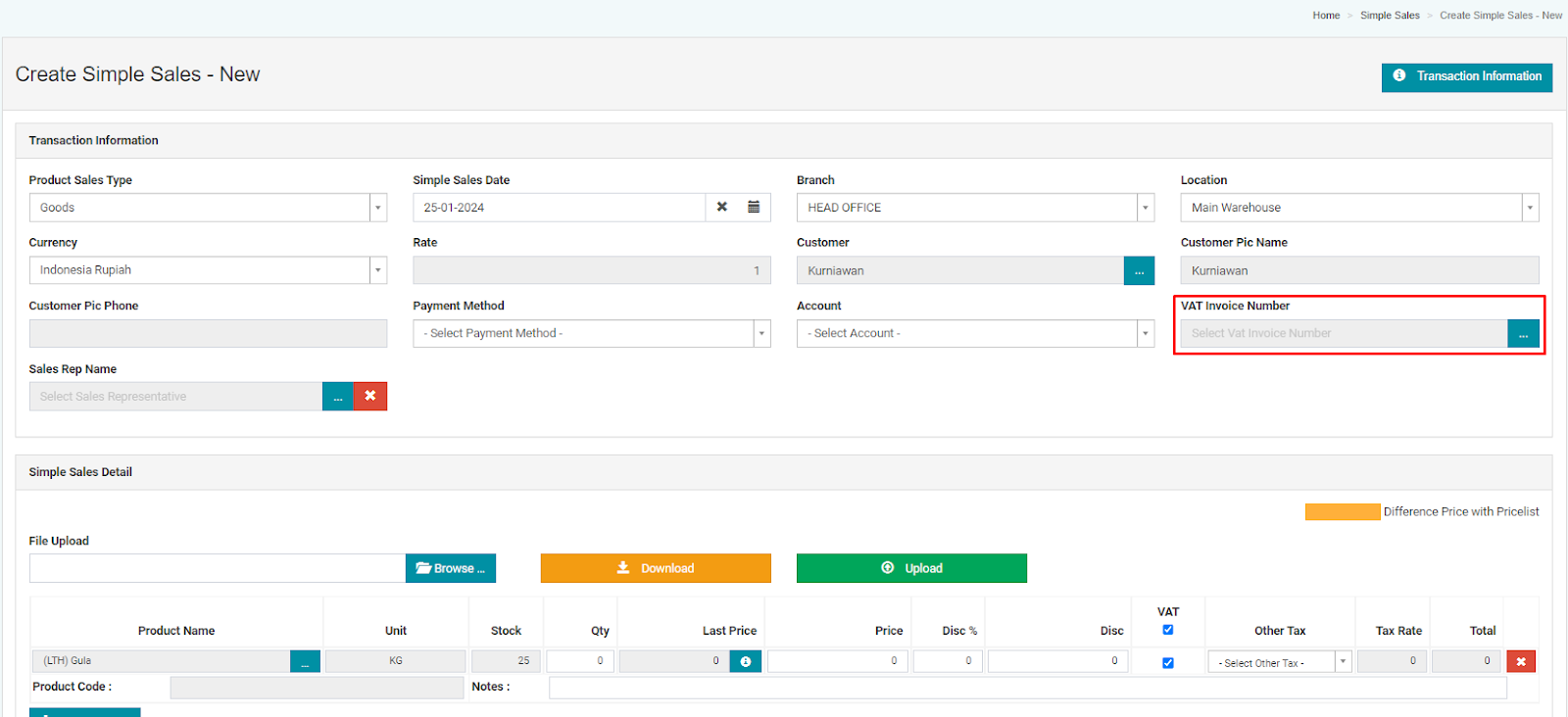

- If the Master VAT Invoice Number already contains data, then in the VAT Invoice Number column, users can select the VAT Invoice Number corresponding to the number registered in the master.

When you click browse, a pop-up like the image below will appear.

Image Description

|

#

|

Column

|

Description

|

|

1

|

Transaction Type Code

|

- The column must be filled.

- The list of selectable data ranges from 01 to 09.

|

|

2

|

Status Code

|

- The column must be filled.

- The selectable data list consists of 0 and 1.

|

|

3

|

Available Invoice Number

|

- To select the tax invoice number to be used,

- Only tax invoice numbers that have not been used are displayed

- Once selected, the data displayed in the VAT invoice number column will be the combination of Transaction Type Code + Transaction Code + the selected tax invoice number.

|

|

4

|

Reference on How to Read Tax Invoice Numbers

|

https://www.online-pajak.com/tentang-ppn-efaktur/nomor-seri-faktur-pajak

|

Example after selecting the VAT Invoice Number.

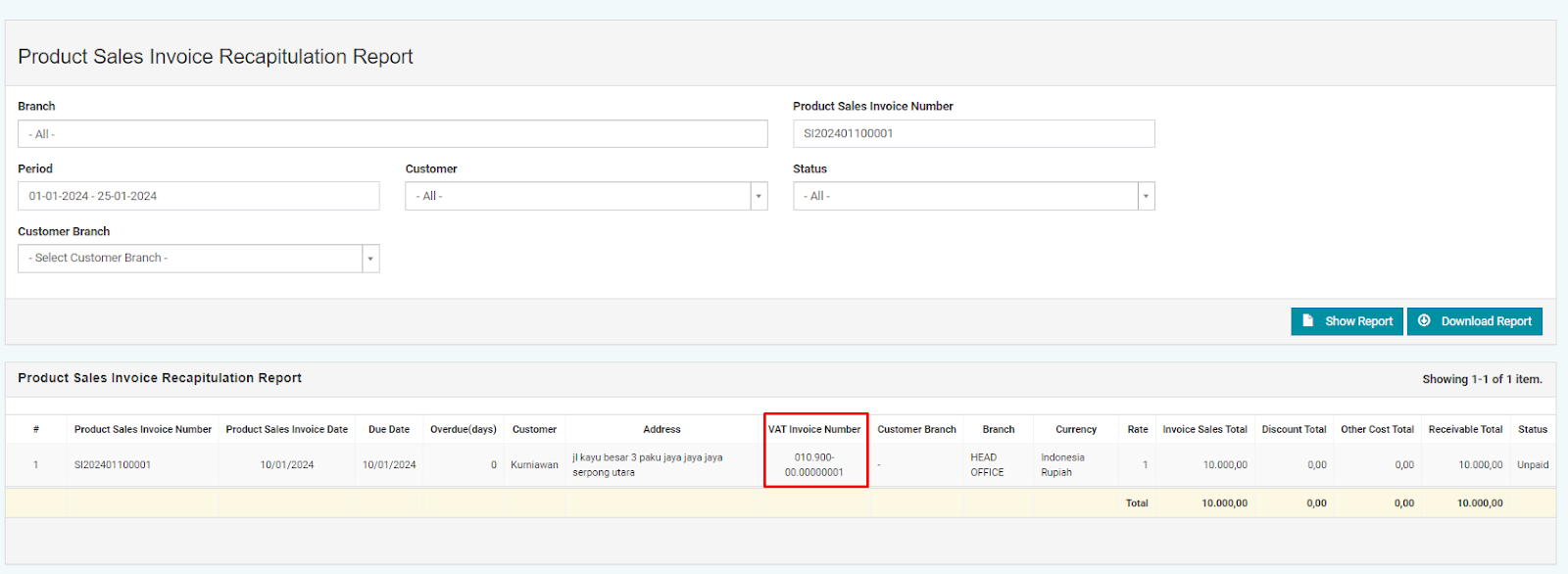

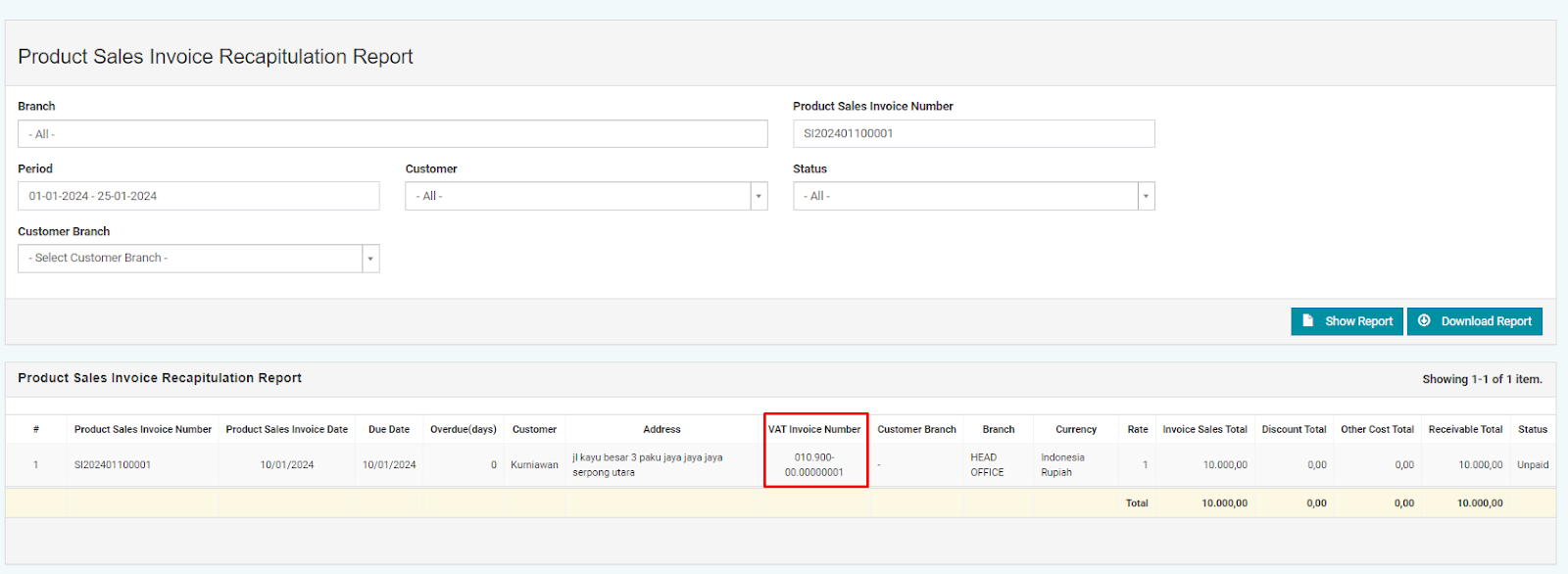

3. Product Sales Invoice Recapitulation Report

In the Product Sales Invoice Recapitulation Report, an additional column has been added to provide information related to the VAT Invoice Number data. This allows users to see whether the sales invoice data has been mapped to the VAT Invoice Number (tax invoice number) or not.

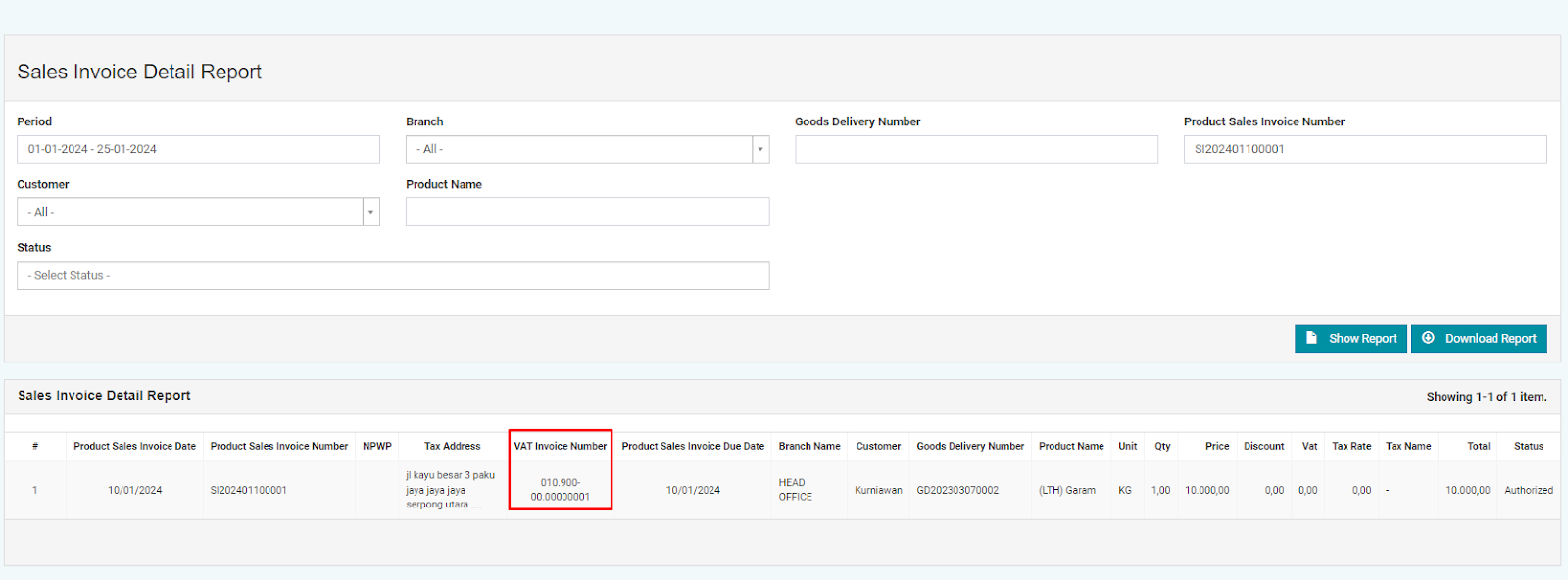

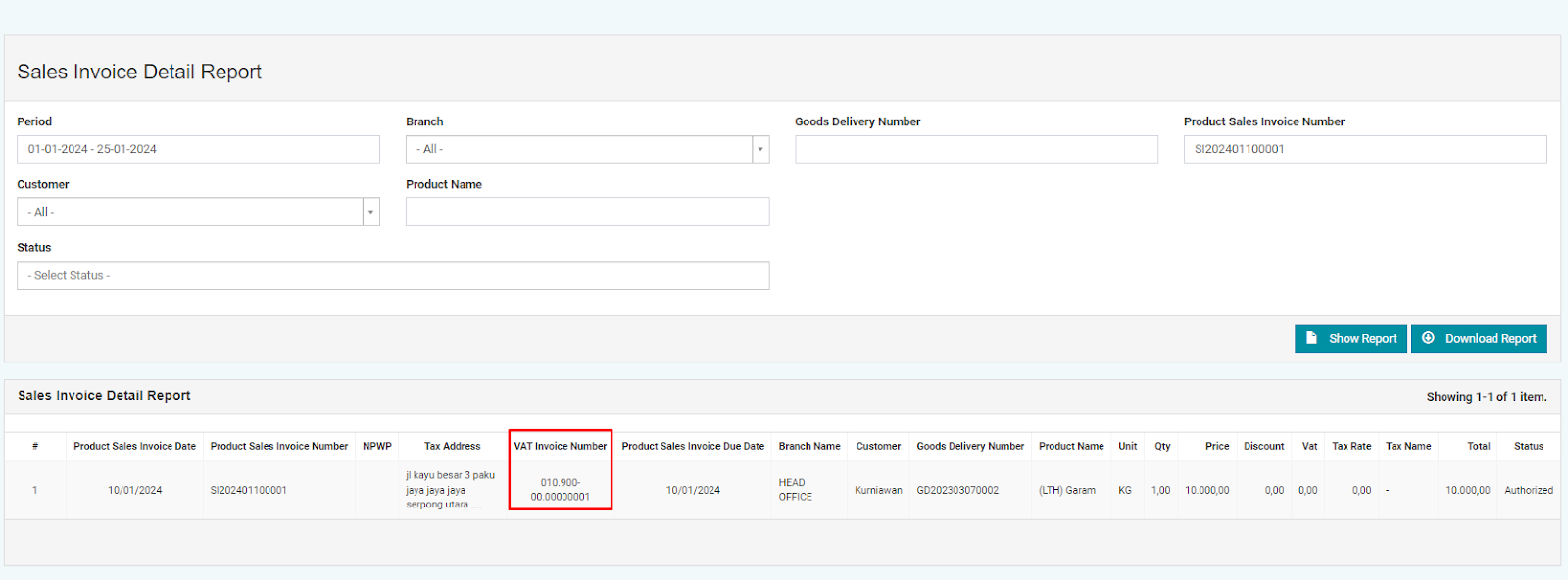

4. Sales Invoice Detail Report

In the Sales Invoice Detail Report, there is an additional column of information related to the VAT Invoice Number data. This allows users to see whether sales invoice data has been mapped to the VAT Invoice Number (tax invoice number) or not.

By utilizing the VAT feature effectively, users can facilitate tax reporting and obtain reports from sales invoice documents or simple sales using tax invoice numbers from the Tax Office (DJP). Additionally, your restaurant business can enhance their financial management more efficiently while ensuring compliance with applicable tax regulations. Therefore, the use of the VAT feature not only aids in optimizing business processes but also serves as a strategic step in strengthening the company's financial foundation. For further inquiries, you can contact us via WhatsApp support careline here.

SHARE

SHARE

SHARE

SHARE