SHARE

SHARE

Important for Business Financial Management, Here

In the business world, we must not underestimate the monthly transaction records. Good transaction records can help us understand the state of our business clearly and accurately. Thus, making it easier for you to evaluate, analyze, and make the right decisions.

There are many examples of transaction journals circulating, so people can create financial reports more easily. But, unfortunately, without good understanding, many transaction journals are incorrect and confusing. So, how do you make the right transaction records? You will find the answer in this article, which thoroughly discusses good and correct sample transaction journals!

Understanding Transaction Journals

Source: Freepik.com

First, you need to know what is meant by transaction journals themselves. Basically, business transaction journals are like record books that contain everything about finances, both income and expenses that occur in a company.

Before you create transaction journals, it's very important to understand the basics of accounting first, which is called the accounting cycle. This accounting cycle is closely related to financial statements because that's what enables us to process the data needed to create journals.

The process starts with checking transaction data and matching it with the available evidence. So, make sure you collect all financial evidence because that's what will provide important information for creating financial statements.

3 Steps to Making Transaction Journals

In general, there are 3 things you need to do to make a systematic transaction journal. Among them:

1. Understand Accounting Equations

Of course, it's very important to understand accounting equations so that you can correctly submit transaction data to the journal. Starting from choosing the accounts used to determine which side is good, debit or credit. The basic accounting equation is:

Assets = Liabilities + Equity

Which can be further elaborated as:

Assets = Liabilities + Equity + (Revenue - Expenses)

By understanding this basic accounting equation, you will find it easier to recognize account groups. For example, inventory is categorized in the asset group. The same goes for accounts receivable, which is also counted as part of assets, and so on.

2. Collect and Identify Transaction Evidence

After understanding the basic accounting equations that are mandatory, the next step is to start collecting transaction evidence to be recorded in the journal. This can be in the form of notes, invoices, bills, or receipts that will be used for the next steps.

Make sure that what goes into the journal is transactions that really affect the financial position, at least two accounts are affected. So, not just any transaction can be included in the transaction journal.

3. General Journal Entry

After sorting out transactions and determining which ones are worthy of being recorded in the general journal, now is the time for you to start journaling using the double-entry system. Here each transaction is recorded twice, namely on the debit and credit sides, but the amounts must be the same. How's that, easy to understand, right?

Example of Business Transaction Journals

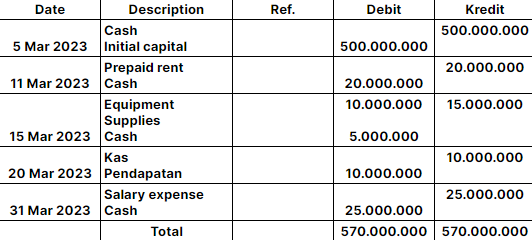

After knowing what things need to be understood and prepared in preparing transaction journals. Here are examples of business transaction journals that will help deepen your understanding. Here's an example:

Collecting Transaction Evidence

- March 5, 2023, Mr. Yogo invested in his company, PT ABCDESB, worth Rp 500,000,000.

- March 11, 2023, paid Rp 20,000,000 for one-year office rent.

- March 15, 2023, buying office equipment with a value of Rp 10,000,000 each and Rp 5,000,000.

- March 20, 2023, received cash income from sales worth Rp 10,000,000.

- March 31, 2023, had to pay February employee salaries amounting to Rp 20,000,000.

Transaction Analysis or Identification

- The investment capital deposit makes the company's assets then increase in the form of Rp 500,000,000 cash (debit), meaning Mr. Yogo's capital increases to Rp 500,000,000 on the credit side.

- The company's assets (cash) decreased by Rp 20,000,000 (credit) for rent payment. So, the company has an asset in the form of prepaid rent worth Rp 20,000,000 (debit).

- Company assets, each equipment increased by Rp 10,000,000 and supplies worth Rp 5,000,000. However, the company's cash assets decreased by Rp 15,000,000.

- Revenue (from sales) increased on the credit side by Rp 10,000,000. The company's assets (cash) also increased by Rp 10,000,000 (debit).

- Salary expenses increased by Rp 25,000,000 (debit). Conversely, the company's assets (cash) decreased by Rp 25,000,000 (credit).

Journal Transaction PT ABCDESB

March 2023

There you have it, an explanation of the understanding, how to make, and examples of business transaction journals that you can try to learn and practice for your business. Remember, a correctly done transaction journal will provide you with accurate information for your business. So, be careful not to make mistakes in arranging transaction journals!

SHARE

SHARE