SHARE

SHARE

Restaurant Tax Calculations You Need to Learn!

Rizki Amelia

If you have a business in the culinary field, you sell food and beverages to meet the needs of people around you. In selling food and beverages, there will usually be a tax known as the restaurant tax. If you're still confused about what restaurant tax is, this article will discuss its definition, types of taxes, and how to calculate it. So pay attention!

Restaurant Tax or PBJT

The restaurant tax, now referred to as the Specific Goods and Services Tax (PBJT), is regulated by Law No. 1 of 2022 regarding taxes paid by end consumers on the consumption of specific goods and/or services.

According to Law No. 1 of 2022, individuals who purchase food or beverages at a restaurant they visit are the subject of this tax. The restaurant's business owner becomes the object of this tax, as they provide food and beverage sales services to buyers.

However, if the restaurant owner is under the same management as a hotel, then they are not included as an object of tax. Additionally, restaurants that provide sales services with annual revenue of less than IDR 200,000,000 (two hundred million rupiah) are also exempt from this tax. This tax has a long period of one month in the calendar.

Obligations of Restaurant Tax or PBJT You Need to Know!

Source: Pajak.io

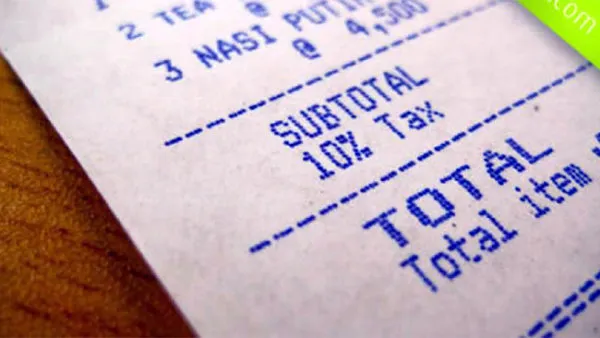

The highest rate for the restaurant tax or PBJT is set at 10%, as stipulated by regional regulations following Law No. 1 of 2022, Article 58, paragraphs 1 and 4. It's also important to know that restaurant tax (PBJT) and Value Added Tax (PPN) are different. These two taxes differ in who collects them: the restaurant tax (PBJT) is collected by the local government (Pemda), while PPN is collected by the central government.

Now that you understand the differences, for those of you in the restaurant business, you must report the Monthly and Annual Tax Returns if you collect:

1. Income Tax Article 21 on payments for salaries, benefits, and bonuses to employees or other individuals providing services.

2. Income Tax Article 23 on service payments to other domestic businesses, is reported only when there is a service transaction.

3. Income Tax Article 25 on annual tax installments, reported as an attachment to the Tax Payment Slip (SSP) or Electronic Tax Payment Slip (SSE) monthly.

4. Income Tax Article 26, regulates payments for services to foreign entities, such as franchises, royalties, or other management services.

5. Income Tax Article 29 on income earned by the company in a fiscal year/month, reported no later than three months after the end of the tax year.

6. Income Tax Article 4 on rent payments for space and buildings, is reported only when a transaction occurs.

7. Value Added Tax (PPN) is applied to transactions using standard tax invoices or similar documents.

Also Read: Easy Ways to Create a Profit and Loss Statement for Your Culinary Business!

How to Calculate Restaurant Tax or PBJT

The restaurant tax or PBJT is collected on services provided by the restaurant to visitors or buyers. The taxable amount for the restaurant tax or PBJT is calculated by multiplying the tax base by the PBJT rate.

Taxable Amount for Restaurant Tax or PBJT = Tax Base x PBJT Rate

Example:

1. The tax base for the restaurant tax or PBJT (the payment amount received/collected according to receipts or other similar documents), for instance, restaurant costs amounting to IDR 70 million; and

2. Restaurant tax or PBJT rate of 10%

So, the calculation for the restaurant tax or PBJT on food and beverages is IDR 70,000,000 x 10% = IDR 7,000,000.

You should also note that Law No. 1 of 2022, Article 59, paragraph 3 explains that sales tax on food is calculated from the time of payment/delivery/consumption of specific goods and services.

Now that you know what’s involved in the restaurant tax or PBJT, you can easily calculate it. This article hopes to encourage you to always pay your restaurant tax!

SHARE

SHARE